How to Build Smart Saving Habits That Actually Work in 2025

Saving money is not easy. In 2025, the prices of things are going up. Food, clothes, and other things cost more. Because of this, it is hard to have extra money. You may want to save money, but it is not always simple. Sometimes, it feels like you cannot save enough no matter what you do.

The best way to save money is to make small habits. Habits are things you do every day or every week. When saving becomes a habit, it is easier. You do not have to think too much about it. Small habits can help a lot over time. Even saving a little money each day or week can grow into more money later.

This guide will show you seven easy ways to save money. Each way is simple to follow. You do not need special skills or plans. These habits help you save money without stress. You will learn how to spend less on small things, plan your shopping, and make saving money a normal part of your life.

If you use these simple habits, you can keep more money for yourself. You will feel safe and less worried about money. Saving will be easier. You can reach your goals faster. Even if money is tight now, these habits can help you have more money in the future.

The Foundation: Setting Clear, Automated Financial Goals

Saving money is important. But many people find it hard. You need to know why you want to save. Saying “I want to save money” is not enough. When you know your reason, it is easier to start and keep saving. A goal helps you stay strong when you want to spend money.

Think about what you want to save for. Ask yourself, “Why do I want to save?” Maybe you want to go on a trip, buy a house, or save for when you are old. Some people save for bad times or for their children’s school. When you know your reason, you can plan how much to save and how long to save.

A good way to save money is to do it automatically. You can ask your bank to share some balance to your savings account every time you get rewarded. This way, you save money before you spend it. You don’t need to think about it, and your money will grow slowly.

Also, understand more related balance. Understand related interest, danger, and how balance can increase. When you learn balance, you can build best choices and feel safe about your future.

Master Your Money with Modern Budgeting Methods

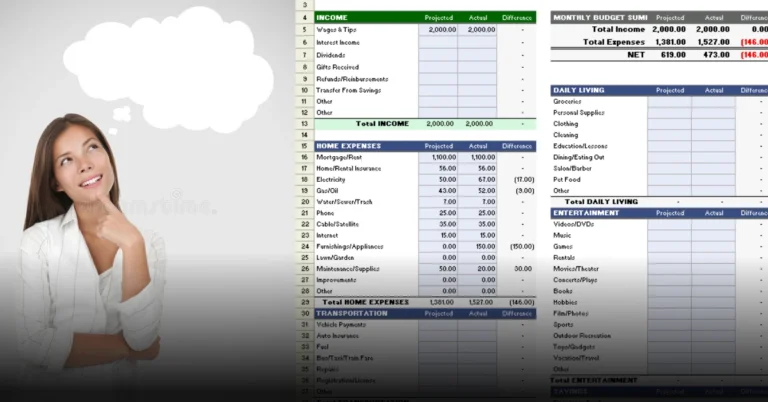

A budget is not something that stops you from spending money. It is a plan to help you use your money well. When you make a budget, you decide where your money will go. It helps you spend on things that are important. A good budget makes life easy and helps you feel safe with your money. It also helps you save money for the future. You can save for a house, a trip, or a small business.

There are different kinds of budgets. One easy plan is the 50/30/20 rule. This means you split your money into three parts. You spend 50% on needs. Needs are things you must have, like rent, food, and bills. You spend 30% on wants. Wants are things you like, such as eating out or shopping. You save 20% or use it to pay your debts. This plan is simple and helps you control your money.

Another plan is called the zero-based budget. In this plan, every dollar has a job. You give a reason for every bit of your money. When you take your income and subtract your spending, you should get zero. This helps you see where your money goes.

You can also use apps to help with your budget. Budget apps show how much money you spend. They tell you what you spend your money on. Apps help you stay on track with your plan. With a good budget, you can save money and reach your goals.

Putting Your Money to Work: 2025 Financial Vehicles

Keeping money in a normal bank is not enough. Money should grow and fight inflation.

High-Yield Accounts and Smart Investing:

- High-Yield Savings Accounts: Put emergency money here. It earns more than normal banks.

- Investing: After saving emergency money, invest in index funds or ETFs. Money can grow over time.

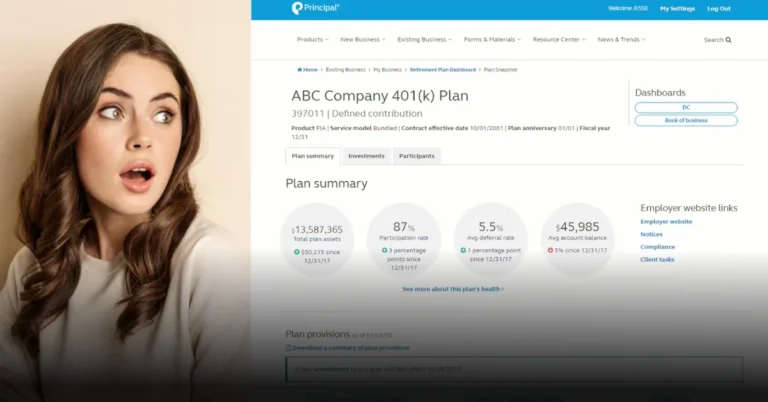

- Tax-Friendly Accounts: Use 401(k), IRA, or ISA. Save on taxes and grow money faster.

Winning the War on Debt and Overspending

Debt stops you from saving. High-interest debt is the worst. Pay it first.

Pay Debt in a Plan:

- Debt Avalanche: Pay highest interest first.

- Debt Snowball: Pay smallest debt first for small wins.

Avoid Lifestyle Inflation: When you earn more, don’t spend more on big things. Save the extra money.

Tactical Saving: Cutting Expenses Smartly

Small changes can save a lot. You do not need to stop enjoying life.

Check Subscriptions: Cancel services you do not use. Ask for lower bills.

Plan Meals: Make a shopping list. Buy only what you need.

Avoid Impulse Buying: Wait 30 days before buying big things. If you still want it, buy it. Otherwise, skip it.

Try Savings Challenges: Make saving fun:

- 52-Week Challenge: Save a small amount each week.

- 100-Envelope Challenge: Save money in envelopes to reach big goals.

Boost Your Income with a Side Hustle

Saving more is easier if you earn more.

Find Extra Work: Do freelance work, part-time jobs, or earn from rent or dividends.

Save Extra Money: Put extra money straight into savings. Don’t spend it. Money grows faster this way.

Embrace Financial Wellness as a Long-Term Habit

Saving is also about your mind. Financial wellness means feeling good about money.

Check Your Money Often: Look at spending, savings, and debt every month. Change the plan if needed.

Ask for Help: Financial advisors can help you make a plan. They can show the best way to save and invest.

Call to Action (CTA)

Are you ready to make 2025 your best financial year? Share this guide with a friend. Comment which habit you will start first. Subscribe for simple tips and updates on money.