Smart Money Habits 2025 – Simple Personal Finance Tips to Save More and Spend Wisely

Do you feel your money is gone before the month ends? You are not alone. Many people have the same problem. The prices of food, rent, and daily things are going up. In 2025, life is more expensive. It is difficult to payment bills and buy what you want. Sometimes it feels like your give money is never enough, even when you duty difficult. To manage this problem. Having a duty is not sufficient. You want best salary habits too. You should plan your using, save some balance per month, and make best choices. Small changes can support you control your balance correct.

This guide will help you use your money well. You will understand how to build a budget, use less, and save for main things. You will also learn how to spend wisely and stay away from debt. These ideas are easy to follow, even if you are just starting to learn about money. If you want to save for the future, pay for daily needs, or feel better about your money This guide will help you step by step.

Master Your Cash Flow: The Foundation of Saving More

The first step to saving money is to know where your money goes. When you track what you earn and what you spend, you can make better choices.

Adopt a Budgeting Method that Works (Budgeting Tips for Beginners)

A budget helps you plan your money. It does not mean you cannot spend. It helps you spend with purpose.

Use the 50/30/20 rule to make a simple budget:

- 50% for Needs: Rent, food, transport, and bills.

- 30% for Wants: Eating out, shopping, and fun.

- 20% for Savings and Debt: Save money and pay off loans or credit cards.

A budget is like a money map that guides your spending each month.

Automate Your Success (Automate Savings Transfers)

The simplest way to save balance is to give money yourself first. This means when you get your balance, put some in your savings before you use anything. You can set it up to happen automatically from your bank account. Try to save 10% to 20% of your balance per month. When it occurs automatically, you save without imagining. This supports your savings increase and reach your aims faster. Automatic saving also stops you from using the balance you need to save. Over time, saving will become a habit. You will feel happy and safe knowing your balance is increasing.

The Best Budgeting Apps 2025 for Intentional Spending

In 2025, there are some tools to serve you manage your balance. These all tools help you save more and use carefully. One app is YNAB (You Need a Budget). It supports you plan your balance before you use it. Another app is Rocket Money. It helps you stop subscriptions you do not use. This saves money. The third app is Monarch Money. It shows all your accounts—bank, savings, and investments—in one place. This helps you see all your money and make better choices. Spending these all apps supports you manage your balance and reach your aims faster.

Eliminate the Wealth Drain: Smart Debt & Spending Hacks

Debt and careless spending can stop you from saving money.

Use these simple tips to spend less and pay off debt faster.

Tackle High-Interest Debt First

In 2025, many people still have big debts from credit cards and student loans.

Start with the debt that costs you the most interest.

There are two popular ways to pay off debt:

- Avalanche Method: Pay off the debt with the highest interest first. You will save more money.

- Snowball Method: Pay off the smallest debt first. It gives you small wins and keeps you motivated.

The important thing is to start paying regularly and stay consistent.

Cut the Subscription Clutter (Cut Unnecessary Expenses)

Check all your monthly subscriptions. Many people pay for things they don’t use. Cancel anything you have not used in the last month.

Use apps like Rocket Money or Truebill to find and cancel unused subscriptions. You can also “subscription hop” — use one streaming service at a time, then switch to another later. Small savings like this can add up over time.

Master Impulse Spending

Online shopping makes it easy to buy things you don’t need. To stop this, use the 24-hour rule: If you want to buy something that costs more than $50, wait one full day.

After 24 hours, you may decide you don’t need it. You can also delete saved credit card details and unsubscribe from shopping emails. This helps reduce the temptation to buy things you don’t really need.

Also Read: How to Manage Your Money Smartly in 2025 – Simple Earning & Saving Guide for Everyone

Play Financial Offense: Grow Your Wealth in 2025

When you control your spending and debt, it’s time to grow your money. Here are some simple ways to build wealth.

Build an Emergency Fund Fast (Create an Emergency Fund Fast)

An emergency fund is money you keep for unexpected events, like losing a job or getting sick. Try to save enough to cover 3 to 6 months of basic living costs.

Start small — save your first $1,000 as soon as you can. Then keep saving little by little until you reach your goal. Put this money in a high-yield savings account so it grows faster and stays easy to use.

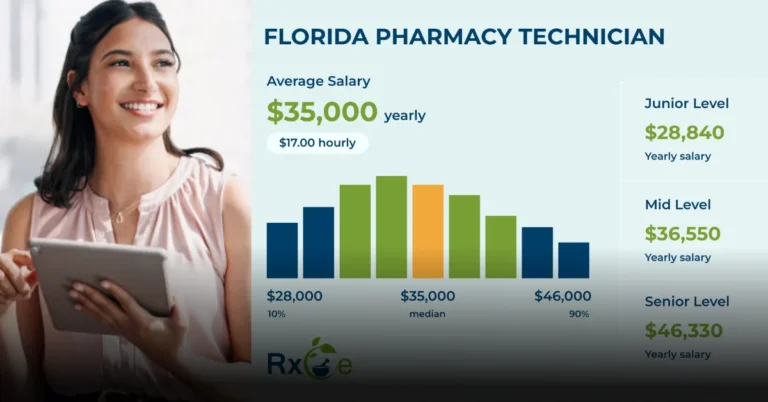

Prioritize Saving vs Investing Wisely

After you pay off your debt and build your emergency fund, start investing your money.

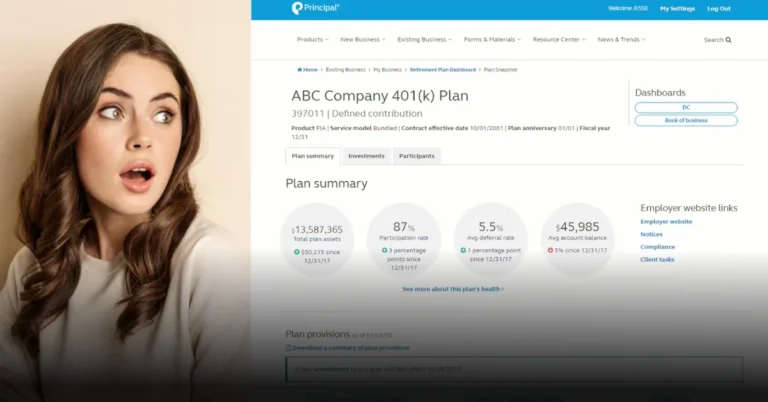

- Tax-Advantaged Accounts: Add money to your 401(k), especially if your job gives a match. You can also use an IRA or Roth IRA for retirement savings.

- Diversify Investments: Invest in low-cost index funds like S&P 500 funds. These help your money grow slowly and safely over time.

Don’t worry about short-term market changes. Focus on the long term and stay patient.

Boost Your Earning Power (Passive Income Ideas for 2025)

Saving is good, but earning more helps you grow faster. Learn new skills, ask for a raise, or start a side hustle.

Here are some passive income ideas for 2025:

- Dividend-paying stocks

- High-interest savings accounts

- Small online business or freelancing

More income gives you more freedom and helps you reach your goals faster.

Final Takeaway and Call to Action

Building smart money habits takes time and practice. It’s not about being strict — it’s about being smart. Each small step helps you move closer to financial peace and a better life. Start today. Choose five money habits from this article and use them this week. You can start a budget, save automatically, or cancel subscriptions you don’t need.

If this article helped you, share it with a friend. Help someone else start their money journey too.

Disclaimer:

This article is for learning only. It is not financial advice. Always talk to a professional before making big money decisions.