How to Create a Monthly Budget Planner That Actually Works for Your Lifestyle

Stop feeling bad about money. Stop using hard spreadsheets that do not work. Many people want to use their money better, but most budgets are too hard or too strict. They do not fit your real life. This can make you feel sad or guilty. If you tried to follow a budget and stopped because it was too hard, you are not alone. Managing money should not make you feel stress. It should help you feel calm and in control. This guide will show you how to make a monthly budget that is simple and easy. You will learn how to make a money plan that fits your life, helps you save, and stops the worry about spending.

This is not about removing all fun or the things you like. It is about finding balance. You can still enjoy your favorite things and be smart with your money. With a clear and simple plan, you will know where your money goes, what you can buy, and how to reach your goals without guilt. Managing money can feel good — and it starts here.

Why Traditional Budgeting Fails for the Modern Lifestyle

Most people stop budgeting because old-style budgets are too strict and stressful. Old budgets are too hard to follow. They want people to be perfect all the time, but nobody is perfect. In real life, money can change anytime. You may get a new bill, a late payment, or lose some money. When this happens, old budgets do not work. People feel sad and think they failed. Another big problem is that old budgets take too much time. Many people try to write down every expense on paper or in a spreadsheet. At first, it feels nice and clean. But after some time, it becomes boring and hard. People get busy and stop doing it.

Traditional budgets are also too rigid. One small issue — like fixing a car or paying a doctor — can break the full plan. Then persons feel bad or upset, but these all things are simple in the life. Finally, old-style budgets ignore human habits and emotions. They only tell people to spend less money. They do not learn how persons really live and feel. The truth is easy: your budget should fit your life, not fight against it. A best budget should be simple and flexible. It should support you stay in control and feel free, not cover.

Also Read: OSRS How to Make Money in 2025 – Complete Beginner’s Guide to Earning Gold

Get the Real Picture (Know Your Numbers)

Before creating a budget, you need to know where your balance really goes.

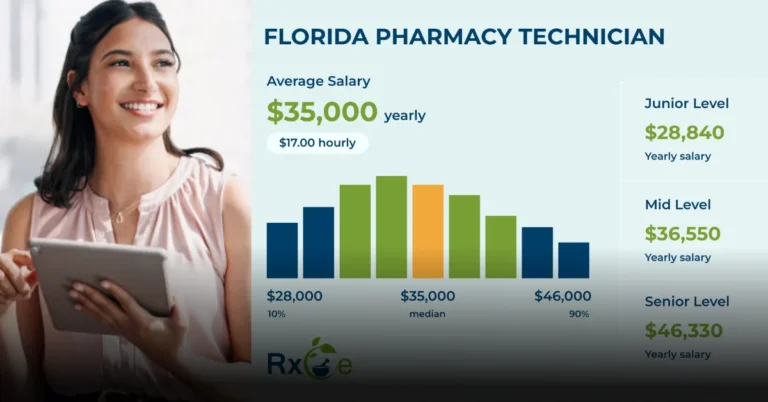

Calculate Your Net Income

This is the balance you get after taxes. If your earning changes each month (for example, you’re a freelancer or gig man), plan spending your lowest earning from the last 3–6 months. Any more balance can go to savings or debt pays.

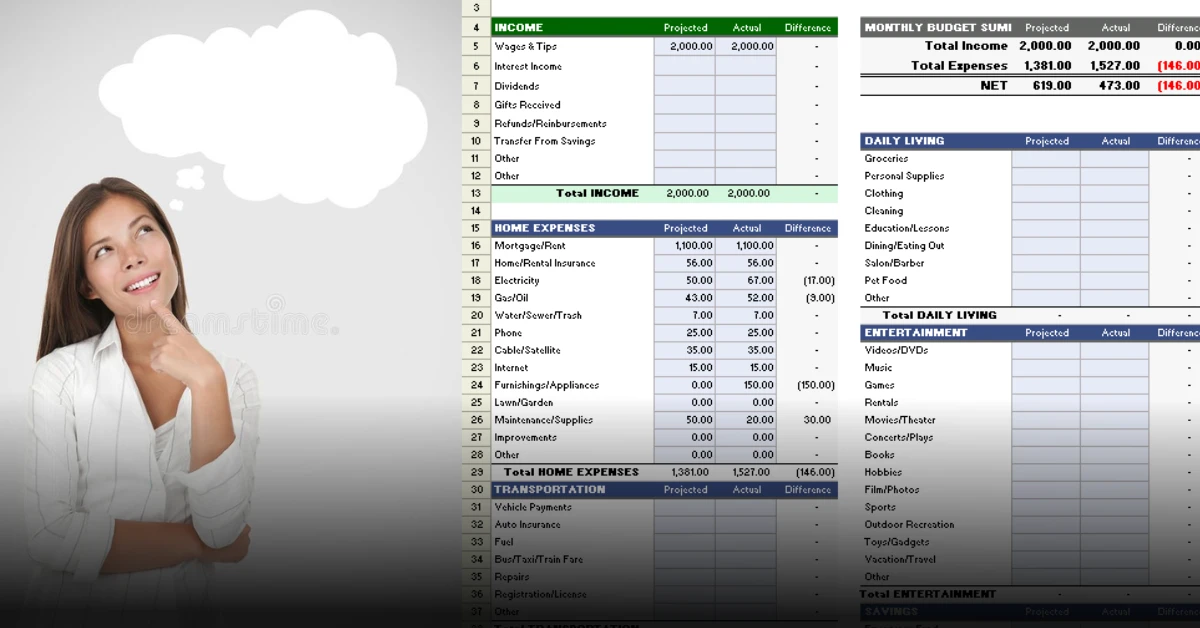

Track Your Expenses

Seek at your last three months of bank and credit card sayings. Split your using into 2 groups:

- Fixed Expenses: Rent, insurance, loan payments, subscriptions.

- Variable Expenses: Food, gas, entertainment, shopping, utilities.

Most people spend the most on housing, transportation, and food. Start finding savings there.

Choose a Budgeting Method That Fits Your Personality

The best budgeting system is the one you’ll actually use. Here are three options:

50/30/20 Rule:

Great for beginners.

Spend 50% on needs, 30% on wants, and save 20%.

Simple and balanced.

Zero-Based Budgeting:

Every dollar has a job.

Best if you often live paycheck to paycheck.

Envelope System:

Good for people who like visual systems.

Put cash (or digital envelopes) into categories like food, gas, or fun.

Tip: Start with the 50/30/20 rule. It lets you enjoy some “wants,” so it doesn’t feel too strict.

Make it Flexible: Incorporate “Life” Money

Budgets fail when they forget about surprise or non-monthly expenses.

Sinking Funds

These are savings for things you know are coming. Add them to your budget:

- Yearly bills like insurance or car registration.

- Irregular costs like medical visits or clothes.

- “Joy money” for travel or hobbies.

Example: If car insurance is $600 every six months, save $100 each month. Then when the bill comes, you already have the money.

“Fun” or “Blow” Money

Give yourself a small budget of guilt-free balance for little more like coffee or snacks. This supports you stick to your plan without feeling caught.

Automate & Optimize Your Plan

The less time you use managing your budget, the simplest it is to keep doing it.

Automate Savings:

Transfer 20% of your earning to savings right after you get paid. This is called “paying yourself first.”

Automate Bills:

Use auto-payments for rent, advance, and subscriptions to avoid late fees.

Use a Budget App:

Many tools can touch to your bank and track your using. Try one that lets you make flexible categories or digital covers.

Review, Adjust, and Master the Art of the Pivot

Your first budget won’t be perfect. That’s okay. The goal is to review and improve.

- Monthly Check-In: At the end of each month, see where you spent more or less than planned.

- Quarterly Check-In: Every three months, check if your goals still make sense.

- Did you spend too much on “fun” money?

- Do you need to increase savings or pay off debt faster?

Remember: a budget is a living plan. Life changes, and your budget should too.

Also Read: High Yield Savings Accounts Explained – A Complete Guide to Smarter Saving in 2025

FAQ: Common Budgeting Challenges

-

What if my “needs” are more than 50% of my income?

Try to reduce costs (like refinancing or cutting bills). If that’s not possible, look for ways to earn more.

-

I live paycheck to paycheck. Where do I start?

Save a small emergency fund of $1,000 first. Then try Zero-Based Budgeting to make every dollar count.

-

Where can I get a free monthly budget sheet or planner?

Many banks and financial websites offer free printable templates. Look for one you can edit to fit your categories.

Ready to Take Control? Your Next Step!

Now it’s your turn. Make your Monthly Budget Planner and start making real financial freedom. Download a easy budget template and try it this month.

Ask yourself: What is one spending category you can cut by 10% this month? Share your aand start your journey today!

Disclaimer:

This article is for education only. It’s not financial, legal, or tax advice. Always check with a trusted professional before making big money decisions.

About the Author

By Geojobs, a Certified Financial Planner (CFP®) with 15 years of experience helping people build personal and family budgets that work in real life.