Step-by-Step Guide to Managing Your Principal 401k Account in 2025

Are you receiving the most from your Principal 401k account? For many persons, this plan from Principal Financial Group is an important part of their retirement savings. Now that we are in 2025, it is a good time to check your account and make sure your money is growing the right way. This simple and easy guide will support you understand how to use your account, save more, and plan for your career.

You will understand how to log in, add extra balance, pick best investments, and follow the new IRS rules. Let’s start your path to a right retirement!

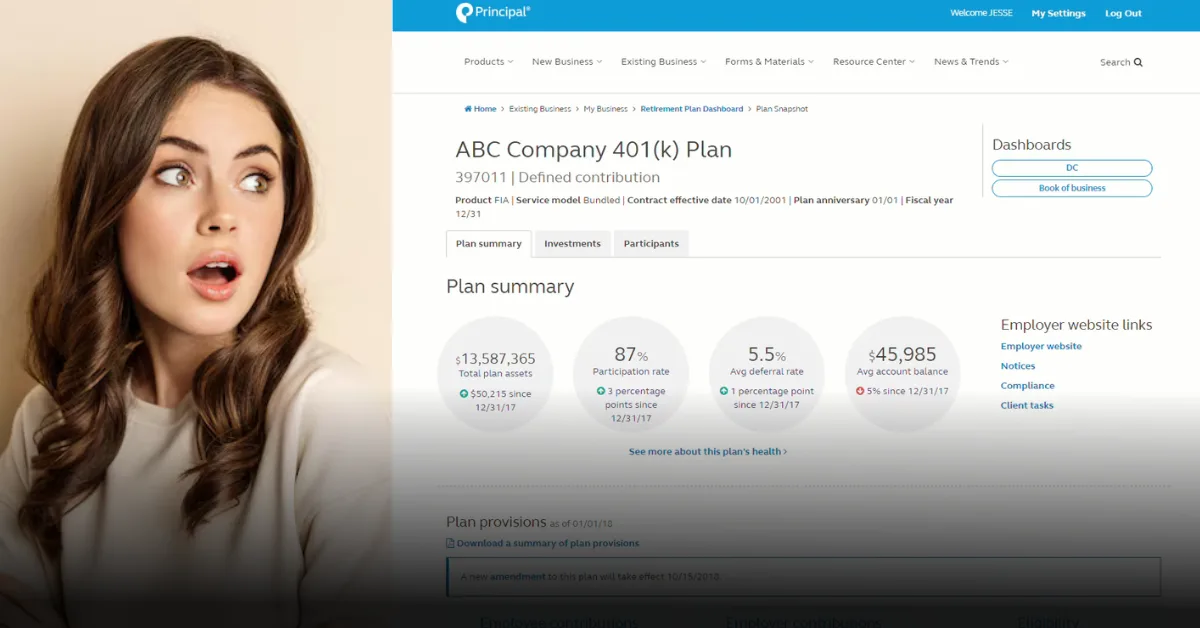

Secure Your 401k Login and Account Access

The first thing you need to do is build sure you can get into your account safely. You can use the Principal site or the Principal mobile app or other sources.

Action Items for Account Setup and Security

Initial Setup:

If you are latest, go to the Principal site and make your account. You will need your Social Security number and your bosses ID.

The Principal App:

Download the tools on your phone. It supports you check your money, see how your funds are doing, and follow your savings whenever.

Enable Two-Factor Authentication (2FA):

Turn on 2FA for more safety. It support keep your account safe from hackers or anyone trying to get in.

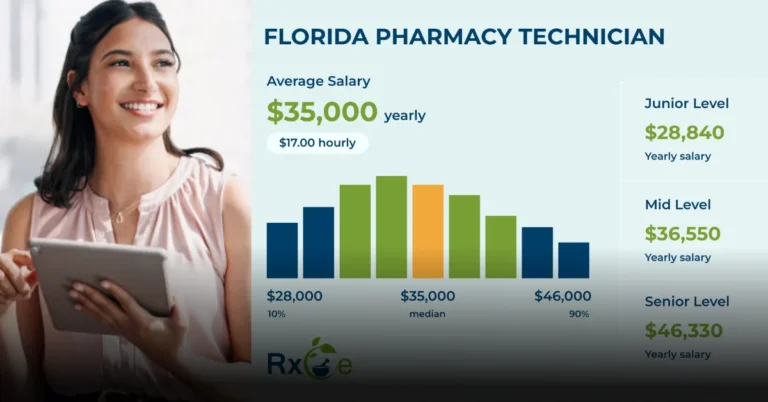

Maximize Your 2025 Contributions

The extra balance you submit to your 401k, the extra it can increase. The IRS sets a limit for how much you can save every year.

Understanding 2025 Contribution Limits

Standard Employee Maximum:

In 2025, the limit is related $24,000 (check the IRS site for the correct number).

Catch-Up Contributions:

If you are 50 years old or older, you can submit more money called a “catch-up donation.”

Employer Match:

If your bosses gives a match, try to put in sufficient to get all of it. This is free balance for your retirement.

You can transfer your savings money on the Principal site or app. Even a small grows, like 1%, can support you make more balance for the career.

Review and Adjust Investments

Your 401k money is invested in different funds. You should check your investments often to make sure they match your age, goals, and comfort level.

How to Evaluate Your Investment Options

Check Your Allocation:

Look at how your money is divided. For example, you may have 80% in stocks and 20% in bonds. You might also use a Target Date Fund that changes as you get closer to retirement.

Evaluate Fund Performance:

See how your funds are doing. Compare them to the market or other similar funds.

Rebalance:

Over time, some funds may grow faster than others. This can change your balance. Use the adjust investments option to bring your mix back to your plan.

Expert Tip: Use the Retirement Wellness Score tool on the Principal website to see how close you are to your goals.

Strategize for Account Transitions (Roll Over Funds)

When you leave a job, you may have money left in an old 401k. You can move that money into your new Principal account or into an IRA. This is called a rollover.

The Seamless Rollover Process

Direct Rollover (Best Option):

Ask your past plan to send your balance directly to Principal Financial Team or to your latest IRA. This keeps your balance safe from taxes and more fees.

Indirect Rollover:

If you get a check, you must put the balance into your latest account within 60 days. If you don’t, you may have to payment taxes and a penalty.

Keeping all your balance in one place builds it simpler to handle and track your savings.

Plan for Future Distributions and Withdrawals

Your 401k is for your career, but it’s best to know how you can take balance out when needed.

Hardship Withdrawals:

You can take money early only if you have a serious need, like paying for medical bills. But you will have to pay taxes and a 10% penalty.

401k Loans:

Some plans let you borrow money from your 401k. You must pay it back with interest. If you don’t, it will be treated as a taxable withdrawal.

Try not to take money out early. The longer it stays in your account, the more it will grow.

Regular Financial Health Check-ups

Check your 401k account often to make sure everything looks right. A short check every few months can help you stay on track.

Quarterly Maintenance Checklist

Review Your Statements:

Log in every three months and read your statements. Check that your balance and your fund information are correct.

Check Vesting Schedule:

If your employer gives matching money, check how long you need to stay at your job to keep it. This is called “vesting.”

Update Beneficiaries:

If you get married, divorced, or have children, update who will get your money if something happens to you.

These small steps help keep your account in good shape.

Leverage Expert Resources (E-A-T Compliance)

You can use expert help and company tools to make better choices for your money.

Consult a Professional:

Talk to a financial advisor if you are moving a large amount of money or need help with taxes.

Company Resources:

The Principal website has many simple guides, videos, and tools to help you learn about saving and investing.

Conclusion and Call to Action

Taking care of your Principal 401k in 2025 means existence active and strong with your balance. Submit as much as you can, check your backup balance often, and use the Principal app to stay latest news. These all small actions will support you make a stronger and safer career.

Don’t wait! Log in today and build sure your savings are ready for 2025. Share this simple and easy guide with friends or coworkers so they can take the control of their 401k too.

Dynamic Disclaimer

Disclaimer: This simple and easy article is for information only. Please visit the Principal Financial Group or IRS sites for the latest and most right details before making any financial selects. This easy article is not personal financial advice ok.