Smart Saving Tips 2025 – Simple Ways to Manage Your Money Effectively

Do you often feel worried about money? You are not alone. Many people feel the same. In 2025, prices for food, houses, and other things are going up. Life is getting more expensive. It can be hard to pay for everything. That is why it is very very important to understand how to spend your balance well. When you understand how to spend and save, you can feel safe and in control of your future.

Good money habits can change your life. They help you save for bad times, reach your goals, and worry less about bills. Saving money is not hard. You do not need to be rich. You can start with simple and small steps. Be patient and try a little per day.

This simple guide will give you easy tips to save money in 2025. It will show you how to save, spend wisely, and grow your savings. Even small changes can help. Try to buy only what you required. Build a plan for your balance every week. With best planning and smart habits, you can feel more sure related your balance and make a right, safer career.

Mastering Effective Money Management with Budgeting

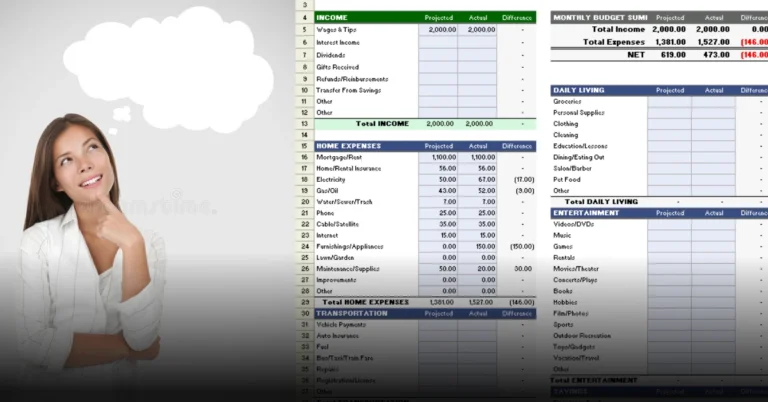

The first step to saving money is to understand how you use it. You need to know how much money comes in and how much goes out.

Track and Control Spending Like a Pro

You don’t need hard math or long spreadsheets. You can use simple phone apps to help you.

Try apps like YNAB (You Need A Budget), PocketGuard, or Monarch Money. These apps show where your money goes. They divide your spending into groups like food, rent, and fun. This helps you see what you spend too much on.

Use the 50/30/20 Rule:

- 50% for needs (rent, food, and bills)

- 30% for wants (movies, shopping, and hobbies)

- 20% for savings or debt payments

Some experts like the Zero-Based Budget. This means you plan how to use every dollar. You decide where your money goes before you spend it. This helps you stay in control and avoid waste.

Also Read: How to Manage Money Wisely in 2025 – A Complete Financial Guide for Everyone

Automating Your Financial Life

Saving is easier when it happens by itself. You don’t have to remember or think about it.

Set up automatic transfers from your main account to your savings account after payday. This means you save first and spend later. When you “pay yourself first,” saving becomes a habit. This is one of the best ways to build money without stress.

Maximizing Your Savings and Building a Safety Net

When you know how to budget, the next step is to make your savings grow. Saving is not just keeping money—it’s also helping your money grow.

The Power of a High-Yield Savings Account (HYSA)

A normal savings account gives very little interest. That means your money grows slowly. A High-Yield Savings Account (HYSA) gives you more interest so your money grows faster.

You can move your emergency fund or short-term savings into an HYSA. In 2025, banks like Vio Bank, Bread Savings, and Synchrony Bank give good rates.

Try to save three to six months of your living costs in your emergency fund. This money will help you if you lose your job or have an emergency. It keeps you from using credit cards or loans.

The Mental Game of Saving

Saving is also about your mind and habits.

You can try the Bucket Method. This means you make small goals for saving. For example, one for “New Phone,” one for “Vacation 2026,” and one for “Car Repairs.” It makes saving fun and clear. You can also use Round-Up Programs. Many banks round up your spending to the next dollar and put the extra cents in your savings. For example, if you buy coffee for $2.60, $0.40 goes to your savings. It’s an easy way to save money without even thinking about it.

Cutting Expenses and Tackling High-Interest Debt

To save more money, you should also spend less and pay off debt.

Prioritizing High-Interest Debt Repayment

Debt, like credit cards, can stop you from saving. In 2025, credit card interest is high—around 23–24%. That means you lose a lot of money if you wait to pay it off. Start by paying the debt with the highest interest rate first. This is called the Debt Avalanche Method. It helps you pay less in interest and save more in the long run.

When you pay off your debt, you can use that money for saving or investing instead.

Frugal Living in the Digital Age

Living simple does not mean you can’t have fun. It means you spend money carefully. Check your subscriptions. You may be paying for things you do not use. Apps like Rocket Money can help you find and cancel them. This can save you a lot of money every year.

Plan your meals and cook at home. Meal prepping saves money and time. It also helps you avoid buying food outside, which costs more.

Follow the 48-hour rule before buying things you don’t really need. Wait two days. If you still want the item after 48 hours, then buy it. If not, you save your money.

Also Read: Step-by-Step Guide to Managing Your Principal 401k Account in 2025

Conclusion: Achieve Your Financial Freedom

The best Smart Saving Tips 2025 mix old and new ideas. You can use modern apps and simple rules to make your money work for you. When you budget, save automatically, and use a High-Yield Savings Account, you start building a strong future. Paying off debt and cutting extra costs will make your savings grow even faster.

Start today and take one small step toward your financial freedom.

Poll: What will you start first in 2025?

(A) Make a budget

(B) Open a High-Yield Savings Account

(C) Pay off high-interest debt

Keep learning more about retirement planning and investing for beginners to grow your wealth even more.

Dynamic Disclaimer

This article is for learning and information only. The tips, apps, and rates are based on 2025 data. Please check details with your bank or a financial expert before making decisions.